- Email:support@posbytz.com

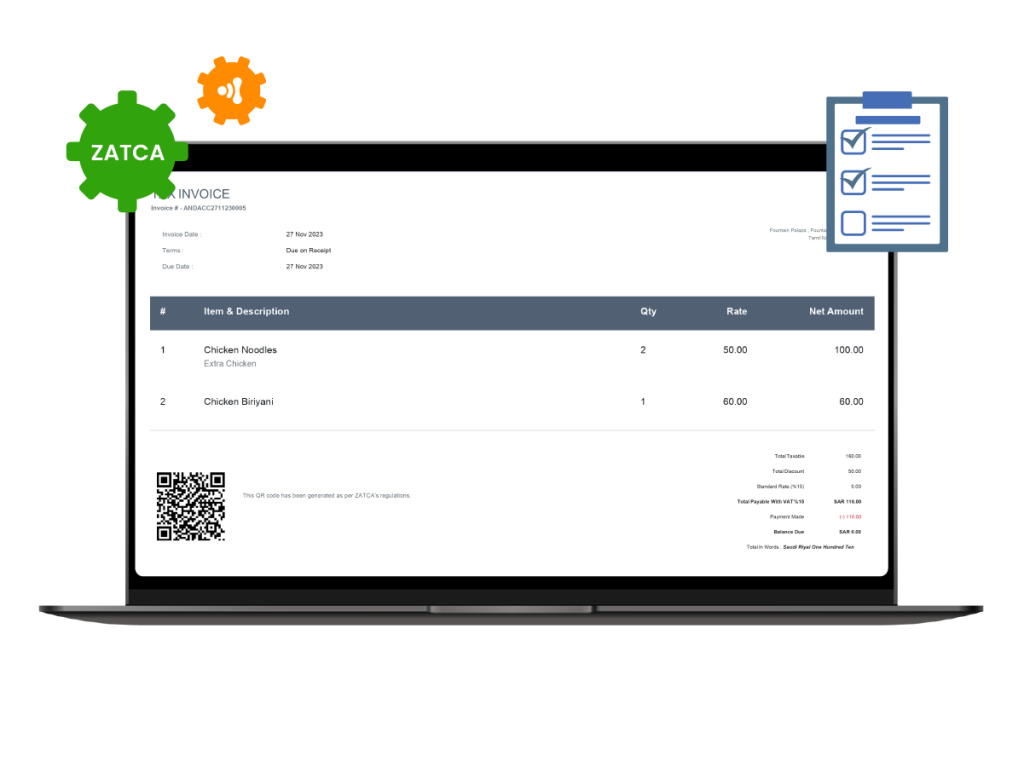

ZATCA approved software

- Home

- E-invoicing

- ZATCA approved software

ZATCA approved software for your e-invoicing compliance in KSA

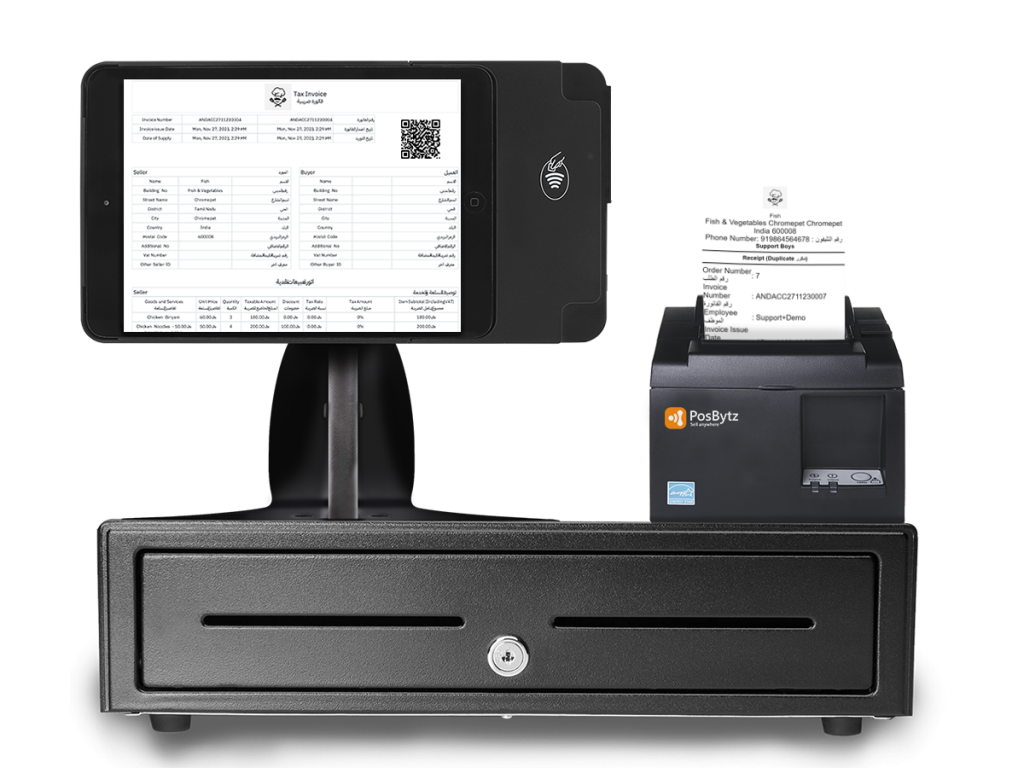

PosBytz a ZATCA approved e invoicing software in Saudi Arabia to manage your Retail and F&B businesses. All in one e invoicing software from POS, inventory, online ordering , CRM, accounting, HR & payroll and many more..,

What is a ZATCA Approved software?

As the Zakat, Tax and Customs Authority ZATCA, Tax Authority of Saudi Arabia has implemented e-invoicing in KSA for B2C and B2B businesses as per regulatory requirements in two phases. ZATCA has reviewed, validated and approved few software providers to facilitate e invoice billing software to all businesses.

ZATCA Approved E invoicing Software Requirements

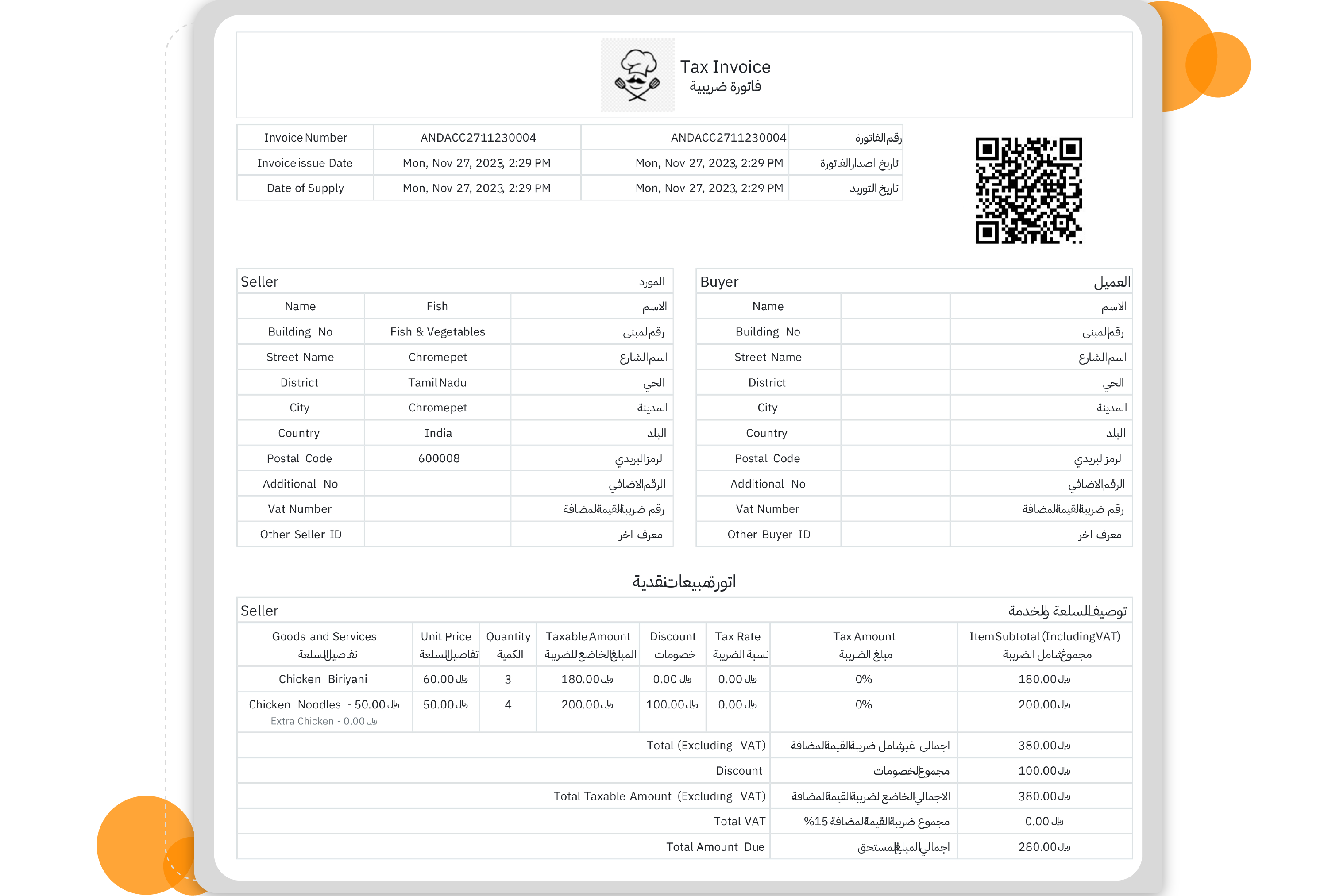

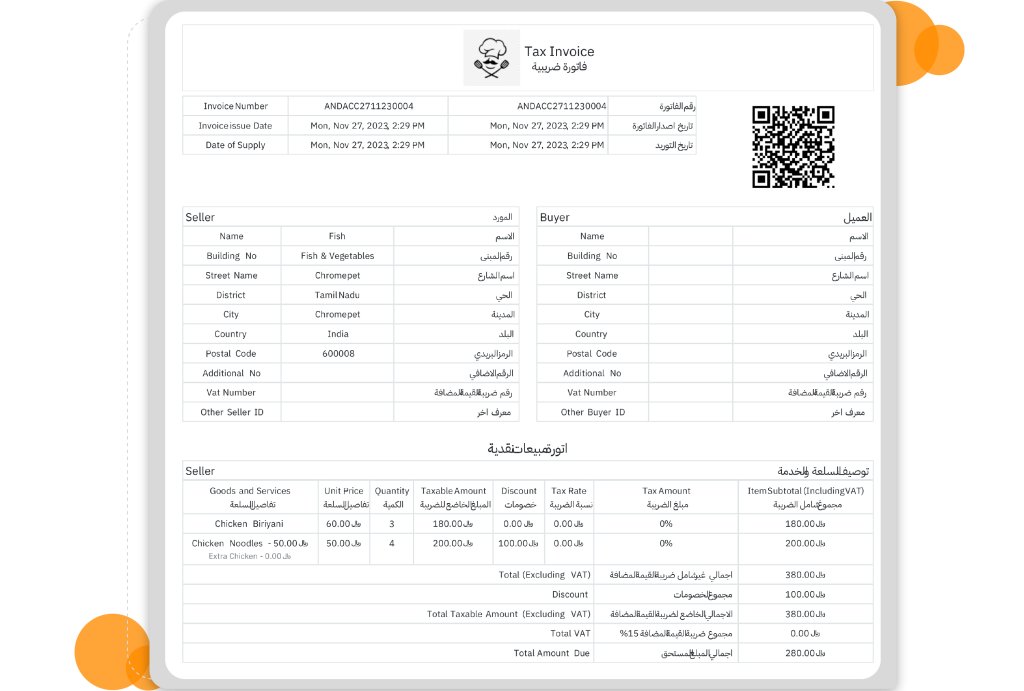

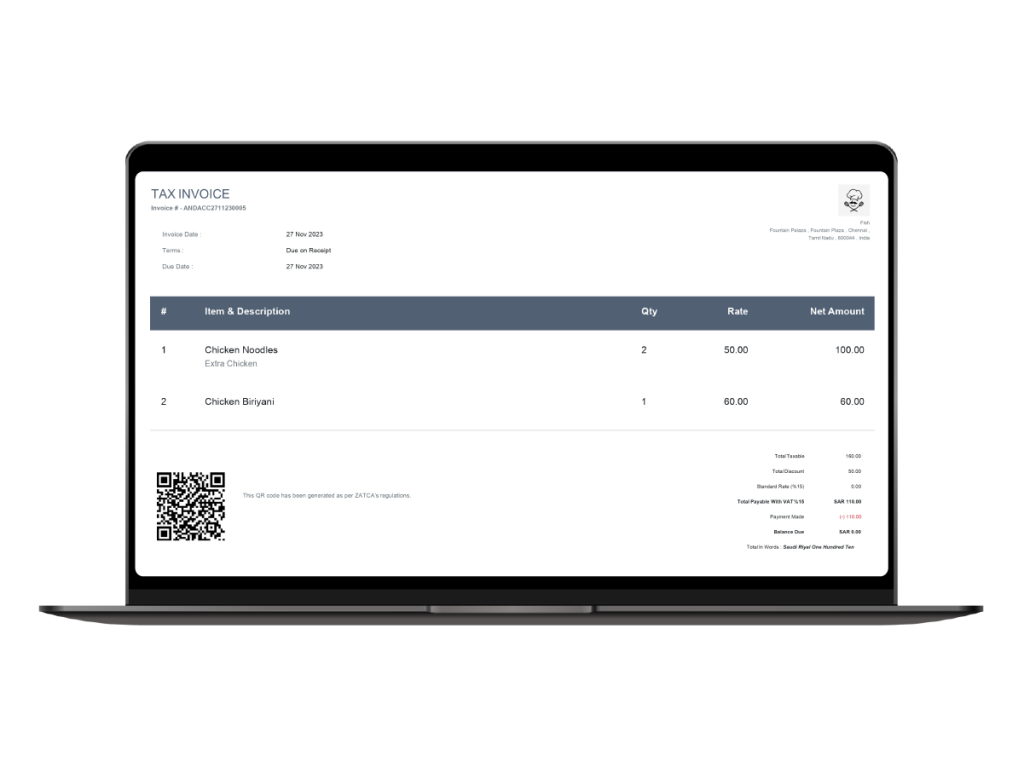

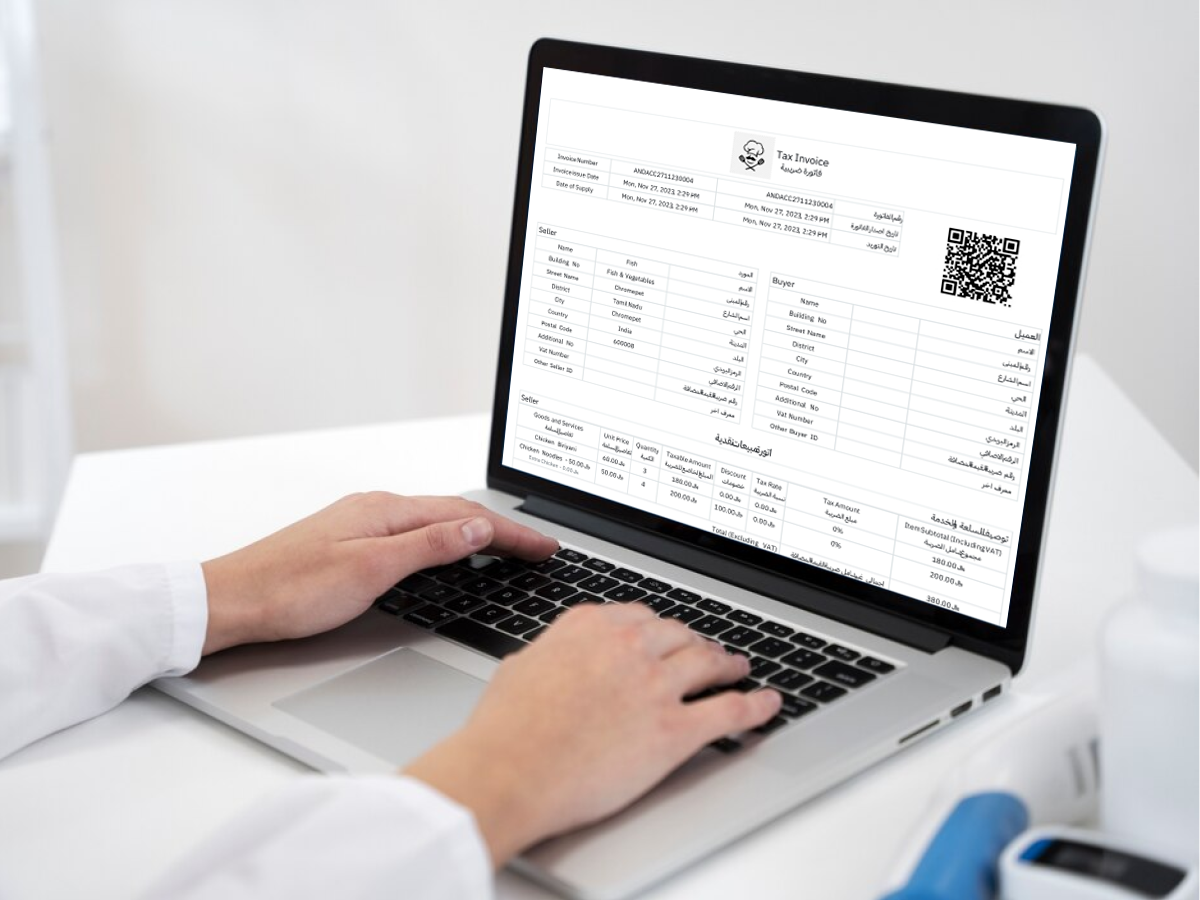

ZATCA approved e invoices with QR codes - Phase 1

- E invoice billing software for various transaction types – Sales, refund/returns, Void, etc.

- Display QR codes on e-invoices or e-notes

- Generate UUID

- Implement mandated fields of e-invoices and associated notes

- Invoices in Arabic & English with QR code as per Phase-1 Compliance

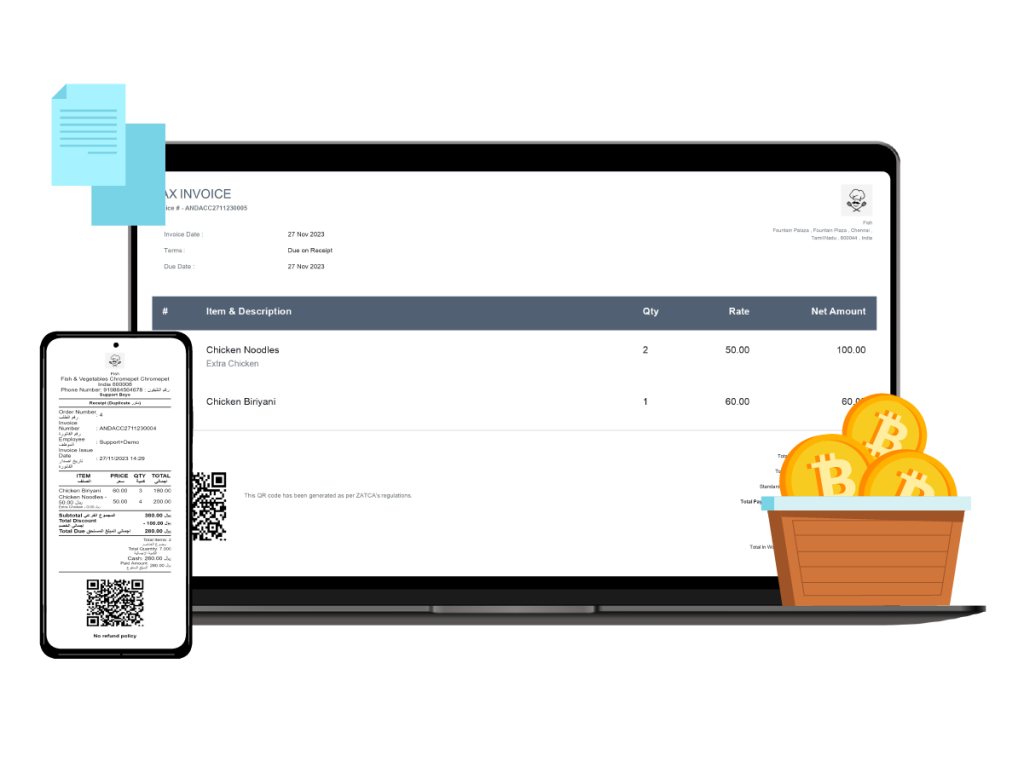

Integration with ZATCA Fatoorah Portal - Phase II

All the invoices must pass through the basic ZATCA’s e-invoicing platform, it requires API integration to connect the e-invoicing solution to the central platform. As per ZATCA approved software below requirements needs to complied for Phase-2

- Sync with ZATCA e-invoicing for all invoices from sales and purchases as per the approved format

- Generate secure PDF/A3 with XML Invoices as per approved format.

- Display QR Code on e-invoices or notes.

- Generate a Universally Unique identifier ( UUID)

- Generate a hash for Each invoice or note,

- Digital stamp mandated

- Tamper-resistant counter

- E-invoice storage as per VAT regulations.

- Integrate with ZATCA Fatoorah platforms through API

E invoice software needs to be complied as below

The Saudi Arabian XML invoice is constructed on UBL 2.1 syntax and the bill definition of EN16931 & A PDF/A- 3 invoice file with an embedded Saudi Arabian XML invoice.

The e-invoice solution must have strict tamper prevention measures, such as a digitized signature and a hash value as a universally unique identifier(UUID).

Generate the QR codes in all the VAT invoices

Upload the XML invoice to ZATCA Fatoorah portal.

Make sure all your transactions are synced from your POS or ERP software

Complete Audit & Compliance as per ZATCA

As per ZATCA compliance, all transactions audit trials as per regulatory need to be stored in the cloud. All ZATCA approved e invoicing software should follow below compliance

- E-invoice storage and archive as per ZATCA compliance

- Tamper resistance counter

- Digital stamp as mandated

- False proof of all transactions

Crypto stamps for anti-counterfeiting in all e invoice billing software

ZATCA compliance crypto signature and stamps are provided by Posbytz, ZATCA approved software. An electronic stamp that is created via cryptographic algorithms to ensure the authenticity of origin and integrity of the content of the data for the Electronic Invoices to ensure the identity verification of the issuer for the Invoices and Notes for the purpose of ensuring compliance with the provisions and controls of the VAT Law and its Implementing

The e-invoice solution must have strict tamper prevention measures, such as a digitized signature and a hash value as a universally unique identifiers.

Archiving requirements for ZATCA approved e invoicing software

Below is the Archiving requirements for ZATCA approved software in Saudi Arabia.

Should backup and Archive the transactions for atleast 5 years.

How it Works?

Check how our ZATCA approved software works

Why choose PosBytz as your E invoicing software?

- Approved software for e-invoicing in Saudi Arabia

- Invoices in Arabic & English, as per ZATCA e invoice billing software requirements

- ZATCA Approved Accounting software inbuilt within the software and affordable e invoicing software price.

- Mini ERP on cloud with all the features from POS , inventory , Accounting , CRM , Loyalty and payroll.

- Seamless ERP integration API's for ZATCA e invoicing phase 2 integrations.

Benefits of choosing ZATCA Compliant Software

- Automate your operations from billing, inventory, consumptions, purchases to reports as per ZATCA compliance

- Auto Data Validation, you can auto validate your e-invoice data to check whether it is according to ZATCA.

- Duplicate e-Invoice Protection, avoid duplicate e-invoices with the feature of duplicate e-invoice protection in our advanced e-invoicing software.

- Dedicated Support Team, a dedicated support team to help you out with any e-invoicing issue.

- Approved e invoicing software for your business compliance with ZATCA Phase-2

Client Testimonials

Trusted By 5000+ Business Globally

Tabiboba, Qatar

We have been using PosBytz for our entire operations with 12 outlets from procurement, preparing Boba recipes, transferring stocks to multiple outlets, accounting. Our operations have been automated from auto PO to POS billing , Online ordering. We would recommend to all Cafe or Boba tea shops to try PosBytz

JazzCafe, KSA

PosBytz Cafe POS Software have been very easy to use and their inventory managment system helps to manage all our inventory accurately and correct our leakages. We are running our business profitably with PosBytz

Mazaarabia, KSA

We are providing broast chicken food across KSA region with about 25 outlets and growing. With PosBytz we have automated the entire operations from purchases, inventory, sales and also enabled our own online ordering system with ease. With defiently recommend PosBytz Restaurant POS software to all F&B brands expanding as a franchise business.

Al Nashama Coffee Qatar

We sell Italian Aroma Coffee at our outlets. PosBytz been a very simple to use POS system and been using for our business for few years now

Sam's Pasta Pizza, Qatar

We are an traditional Italian cuisine based brand. Have been using PosBytz for our Restaurant Management operations and so far there has been no issues with respect to the software and as a owner can able see my business online from anywhere. PosBytz is very easy to use for setting up menu , ingredients/recipes , POS , inventory etc..,

Teklos UAE

We are UAE based F&B brand having both restaurant and online presence. With PosBytz we are able to manage both outlets and online ordering through Talabat , Careem etc.., in one POS and manage the pricing & inventory for one single place helped us to streamline our operations and reduce cost. Would always recommend PosBytz for Restaurant business.

Frequently asked questions:

What is e invoicing in Saudi Arabia?

The e invoicing system where business-to-business (B2B) and business to customers (B2C) invoices are digitally prepared in an e-invoicing format and authenticated by the ZATCA e-invoicing system.

What are the ZATCA compliant software in Saudi Arabia?

There are few software vendors approved by ZATCA for e-invoicing in Saudi Arabia compliant to Phase-1 and Phase -2. There are best ZATCA approved e invoicing software in KSA.

Is ZATCA e invoicing mandatory in Saudi Arabia?

Yes, It's mandatory to have all invoices be ZATCA e-invoices compliant software for all the billing processes in Saudi Arabia.

Does my business needs to comply with ZATCA e invoicing ?

Yes, all registered businesses operating under the regulations of Saudi Arabia should be ZATCA compiled.

What is e invoicing software cost in Saudi Arabia?

There are multiple e invoicing software price options for e-invoicing either on per transaction or annually as subscription.

How can I check if my E-invoicing software is ZATCA approved?

You can verify the ZATCA approval status on the official Zakat and Tax Authority website or contact their support for confirmation.

Is approved E invoicing software suitable for all business sizes?

Yes, ZATCA einvoicing caters to businesses of all sizes, offering scalable solutions to meet varying invoicing needs.

Is training provided for using ZATCA-approved software?

Many providers offer training and support services to help businesses effectively implement and utilize the software.

What documentation is required for ZATCA approved E invoicing software?

The required documentation may include technical specifications, security measures, and compliance details. Consult with the ZATCA guidelines or your software provider for specific requirements.

How frequently does ZATCA update its E invoicing standards?

ZATCA may update its standards periodically. It's crucial to stay informed about any changes and ensure that your software remains compliant.

Unlock Compliance and Efficiency with ZATCA Approved E Invoicing Software.

Sign up now for seamless, secure, and ZATCA approved software in Saudi Arabia

PosBytz is a ERP software for Restaurant and Retail business on cloud with POS, Online ordering, Inventory, Accounting, CRM , Payroll and many more

PosBytz is a product of Inovo Holdings Ltd