- Email:support@posbytz.com

Accounting, ERP, Restaurant

Streamlining Restaurant Operations with Restaurant Accounting Software: A Comprehensive Guide

- No Comments

14 Jun

Struggling to manage the financial aspects of a small restaurant can be a daunting task. With the constant influx of orders, inventory management, and employee salaries, it’s easy to get overwhelmed. Restaurant accounting software is a crucial tool for small restaurants to manage their finances efficiently. It helps streamline operations, reduce errors, and provide valuable insights to make informed decisions. In this comprehensive guide, we will explore the benefits of using restaurant accounting software, its features, and how it can help small restaurants thrive.

The Importance of Accounting System for Restaurants:

Restaurant accounting software is designed to cater to the unique needs of the food service industry. It helps manage various aspects of a restaurant’s operations, including inventory management, cost control, and financial reporting. By automating these tasks, restaurant accounting software reduces the risk of errors and frees up staff to focus on more critical tasks.

1. Small Restaurant Accounting Software:

Purpose: This software is specifically designed to cater to the needs of small restaurants. It is user-friendly and offers a comprehensive solution for managing all financial aspects of the business.

- Functions:

- Expense Tracking:

- Detailed Monitoring: Keep a meticulous record of all expenses, including food costs, labour costs, utilities, rent, and other operational expenses.

- Financial Accuracy: Ensure that all expenditures are accurately recorded to maintain precise financial statements and avoid discrepancies.

- Inventory Management:

- Stock Level Monitoring: Track inventory levels in real-time, ensuring that the restaurant never runs out of essential ingredients.

- Usage Tracking: Monitor the usage rate of various inventory items to help forecast future needs and prevent overstocking or understocking.

- Reorder Management: Automate the reordering process to maintain optimal inventory levels, reducing manual efforts and potential errors.

- Financial Reporting:

- Comprehensive Reports: Generate various financial reports such as income statements, balance sheets, and cash flow statements to gain insights into the financial health of the restaurant.

- Performance Analysis: Use these reports to analyse performance trends, identify areas for improvement, and make informed financial decisions.

- Expense Tracking:

2. Accounting System for a Restaurant:

- Purpose: This system is tailored to meet the specific financial management needs of restaurants, ensuring that financial data is accurate, timely, and useful for decision-making.

- Functions:

- Accounts Payable Management:

- Supplier Payment Tracking: Keep track of all payments due to suppliers and vendors to ensure timely payments and maintain good relationships.

- Expense Categorization: Categorize expenses to better understand spending patterns and manage cash flow effectively.

- Accounts Receivable Management:

- Customer Payment Tracking: Monitor payments received from customers, including catering services, events, and regular dining operations.

- Invoicing: Generate and send invoices to customers promptly, ensuring timely payments and accurate records.

- Payroll Management:

- Employee Payment Processing: Manage the payroll process efficiently, ensuring that all employees are paid accurately and on time.

- Tax Calculations: Handle tax withholdings and other deductions automatically, reducing the risk of errors and ensuring compliance with regulations.

Key Features of Restaurant Accounting Software:

1.Recipe Management

Recipe Costing:

Cost Tracking:

Ingredient Costing: Accurately track the cost of each ingredient used in recipes to ensure precise menu pricing.

Labour Costing: Include labour costs in the recipe costing process to get a full picture of each menu item’s expenses.

Profitability Analysis:

Menu Optimization: Analyse the profitability of each menu item to identify which items are most profitable and which are not, allowing for better menu planning.

Cost Reduction: Identify opportunities to reduce ingredient or labour costs without compromising quality.

Budgeting:

Cost Control: Use detailed costing information to set realistic budgets and control expenses effectively.

2.Cost of Goods (COGS)

COGS Tracking:

Budget Alignment:

Real-Time Monitoring: Continuously monitor the cost of goods sold to ensure it aligns with the restaurant’s budget.

Variance Analysis: Identify any variances between actual costs and budgeted costs to take corrective action promptly.

Cost Reduction:

Efficient Purchasing: Optimize purchasing strategies to reduce costs, such as negotiating better prices with suppliers or buying in bulk.

Inventory Management: Improve inventory turnover rates to reduce holding costs and minimize waste.

3.Wastage Management:

Wastage Tracking:

Food Waste Monitoring:

Detailed Tracking: Track food waste meticulously to understand where and why wastage is occurring.

Loss Prevention: Implement strategies to reduce food waste, such as better portion control or repurposing ingredients.

Inventory Optimization:

Usage Analysis: Analyse usage patterns to optimize inventory levels and reduce the likelihood of spoilage.

Waste Reduction: Implement measures to reduce waste, such as first-in, first-out (FIFO) inventory management and regular stock audits.

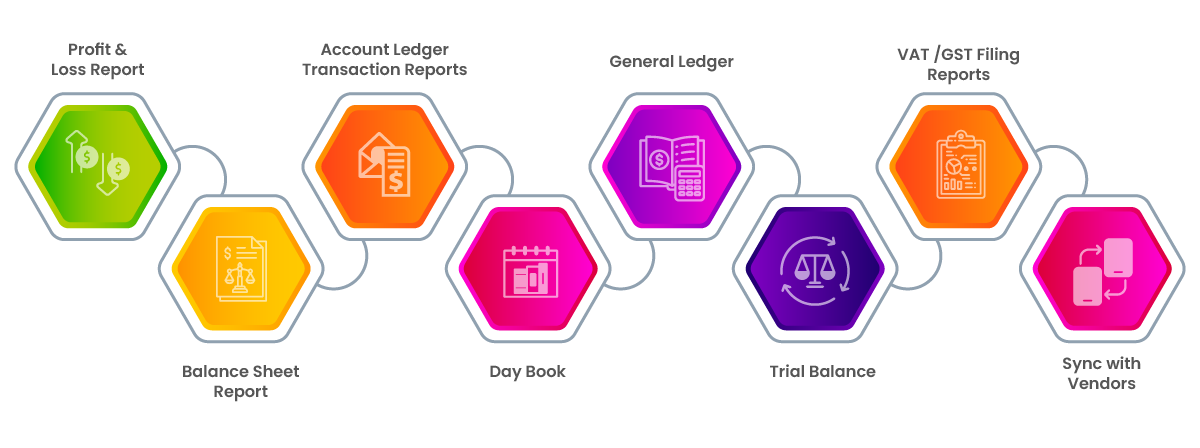

Financial Reports from a Accounting System for Restaurants

1.Profit & Loss Report

Profit & Loss Statement:

Performance Tracking:

Detailed Insights: Generate detailed profit and loss statements to track the financial performance of the restaurant over specific periods.

Revenue vs. Expenses: Compare revenue against expenses to determine profitability.

Budgeting:

Cost Management: Identify cost-saving opportunities by analyzing the components of expenses and revenue.

Financial Planning: Use the insights gained to create more accurate budgets and financial plans.

2. Balance Sheet Report

Balance Sheet:

Financial Position:

Asset Tracking: Track all assets, including cash, inventory, equipment, and real estate.

Liability Management: Monitor liabilities, such as loans, accounts payable, and other debts.

Financial Adjustments:

Equity Analysis: Evaluate the equity position to understand the financial health and stability of the restaurant.

Improvement Opportunities: Identify areas for financial adjustments and improvements to enhance overall financial health.

3.Account Ledger Transaction Reports

Account Ledger:

Transaction Details:

Comprehensive Record: Generate detailed reports of all financial transactions to ensure transparency and accuracy.

Audit Trail: Maintain an audit trail for all transactions to facilitate internal and external audits.

Error Identification:

Data Accuracy: Spot and correct errors promptly to ensure the integrity of financial data.

Reconciliation: Reconcile accounts regularly to ensure that all records are accurate and up-to-date.

4.Day Book

Day Book:

Real-Time Tracking:

Daily Transactions: Record all financial transactions on a daily basis to maintain real-time financial data.

Cash Flow Monitoring: Monitor daily cash flow to manage liquidity effectively.

Accuracy:

Error Detection: Ensure data accuracy by identifying and correcting discrepancies as they occur.

Daily Reconciliation: Perform daily reconciliations to keep financial records accurate and reliable.

5.General Ledger

General Ledger:

Comprehensive Tracking:

All Transactions: Track all financial transactions in detail, including revenues, expenses, assets, and liabilities.

Historical Data: Maintain a historical record of all transactions for future reference and analysis.

Financial Health:

Performance Evaluation: Use the general ledger to evaluate the overall financial health of the restaurant.

Adjustment Identification: Identify areas where financial adjustments are needed to improve performance.

6.Trial Balance

Trial Balance:

Transaction Accuracy:

Balancing: Ensure that all debits and credits are balanced to verify the accuracy of financial records.

Error Detection: Identify and correct errors before they affect financial statements.

Error Correction:

Data Integrity: Maintain the integrity of financial data by regularly generating and reviewing trial balances.

Pre-Closing Check: Use the trial balance as a pre-closing check to ensure accuracy before finalizing financial statements.

7.VAT / GST Filing Reports

VAT / GST Filing:

Tax Compliance:

Regulatory Requirements: Generate detailed reports for VAT/GST filing to ensure compliance with local tax regulations.

Timely Filing: Ensure that all tax obligations are met on time to avoid fines and penalties.

Risk Reduction:

Accurate Reporting: Reduce the risk of errors in tax filings by using accurate and detailed reports.

Audit Preparedness: Be prepared for tax audits by maintaining comprehensive and accurate tax records.

8.Sync with Vendors

Vendor Integration:

Account Syncing:

Vendor Accounts: Sync vendor accounts to streamline the ordering and payment processes.

Purchase Orders: Automate the creation and management of purchase orders to reduce manual effort.

Streamlined Ordering:

Error Reduction: Reduce errors in the ordering process by automating data entry and synchronization.

Time Savings: Save time on administrative tasks, allowing staff to focus on more critical activities.

Automated Processes:

Data Flow Automation:

Seamless Integration: Automate data flow between different systems and processes to ensure consistency and accuracy.

Error Minimization: Minimize errors by reducing manual data entry and ensuring automatic updates.

Efficiency Improvement:

Staff Focus: Free up staff to focus on more critical tasks by automating routine processes

Operational Efficiency: Improve overall operational efficiency by reducing the time and effort required for financial management.

Conclusion

Small Restaurant accounting software is an indispensable tool for small restaurants to manage their finances efficiently. By automating various financial tasks, it reduces errors and provides valuable insights for making informed decisions. Key features such as recipe management, cost of goods tracking, wastage management, and comprehensive financial reporting help small restaurants thrive. This software enhances efficiency, ensures compliance, and supports the overall financial health of the restaurant, allowing owners to focus on delivering exceptional dining experiences to their customers.

FAQs

1.What are the key features of restaurant accounting software?

Key features include creating chart of accounts, account mapping , multiple payment methods, Dashboard & reports, Account receivable , Account Payables, Credit note, Balance sheet , Trial balance, p & L reports etc..,

2.How does restaurant accounting software help reduce errors?

Restaurant accounting software automates various tasks, reducing the risk of errors and ensuring accurate data flow.

3.What kind of financial reports can accounting system for restaurants generate?

Restaurant accounting software can generate detailed reports such as profit and loss statements, balance sheets, account ledger transaction reports, day books, general ledgers, trial balances, and VAT/GST filing reports.

4.How does restaurant accounting software help with inventory management?

Restaurant accounting software helps track inventory levels, monitor wastage, and identify areas where costs can be reduced.

5.Can restaurant accounting software be integrated with vendors?

Yes, restaurant accounting software can be integrated with vendors to streamline the ordering process, payments , stock replenishment and reduce errors.

5.Does PosBytz offer POS software along with Restaurant Accounting software?

Yes, restaurant accounting software also includes cloud based Restaurant POS software works offline

5.Can we also sell Online with Integrated Online ordering system ?

Yes, PosBytz Restaurant Online ordering system offers website and apps for Online ordering.

Click here to get more details about PosBytz ERP with Accounting system for Restaurants

Recent Posts

- Ultimate Guide to the Best Retail Accounting Software: Streamline Your Business Finances

- “Mastering Retail Success: Your Ultimate Guide to Choosing The Best Retail ERP Software”

- The Transformative Power of ERP for Retail Stores: Streamlining Operations and Boosting Profitability

- “Streamlining Retail Operations with a Retail Accounting System”

- “Revolutionize Your Retail Business with Retail ERP Software”

PosBytz is your comprehensive platform to manage everything you need to sell and grow your business.

PosBytz is a product of Bytize, Inc.