- Email:support@posbytz.com

01 Nov

E invoicing Saudi Arabia represents the future of invoicing. As a business, it is essential to evolve with the market trends. The benefits of having e-invoicing software include simplifying the accounting process, validating the invoices with minimal risk, and eliminating the costs incurred. If you are a business in Saudi Arabia, you need to make a few preparations for the new changes that are coming in from ZATCA Tax Authority in Saudi Arabia

On May 28, 2021, Saudi Arabia’s General Authority combined with the Customs Authority to create the Zakat, Tax and Customs Authority(ZATCA). They had finalized the legislation of e-invoicing. This means that e-invoices are mandatory for B2B, B2C and B2G transactions and has two phases of implementation.

The first phase begin on December 4, 2021 and completed.

The second phase started on January 1, 2023. This phase is implemented in many phases based on the turnover of the business. Below is the schedule currently applicable for businesses based on the turnover.

- Wave 1 under e invoicing Saudi Arabia phase 2: VAT registered businesses in KSA having more than SAR 3 billion in 2021 fall under wave 1 and must comply with Phase 2 w.e.f 1st January 2023.

- Wave 2 under ZATCA e invoicing phase 2: Businesses registered under Saudi VAT with more than SAR 500 millon and less than SAR 3 billion turnover fall under wave 2 and shall comply with phase 2 w.e.f 1st July 2023.

- Wave 3 under e invoicing Saudi Arabia phase 2: Businesses registered under Saudi VAT with more than SAR 250 millon shall comply with phase 2 w.e.f 1st Oct 2023.

- Wave 4 under e invoicing Saudi Arabia phase 2: Businesses registered under Saudi VAT with more than SAR 150 millon shall comply with phase 2 w.e.f 1st Nov 2023.

- Wave 5 under ZATCA phase 2: Businesses registered under Saudi VAT with more than SAR 100 millon shall comply with phase 2 w.e.f 1st Nov 2023.

- Wave 6 under ZATCA phase 2: Businesses registered under Saudi VAT with more than SAR 70 millon shall comply with phase 2 w.e.f 1st Jan 2024.

This would be mandatory for all businesses irrespective of turnover from Mar 2024 as per latest mandate issued by ZATCA. To know more about ZATCA compliance and e invoicing Saudi Arabia.

According to this law, businesses in KSA must create e invoice KSA for domestic transactions. The e-invoices are generated for VAT purposes.

The exact expectations for the format, the content and the safety measures vary according to the two phases.

Phases of e-invoicing Saudi Arabia

Phase 1 (Generation)

This phase aims to gradually shift the suppliers from handwritten invoices and storage of paper format. This gradual upgradation would help them be more ready for phase 2 and get the right e-invoicing solution.

In phase 1, VAT-registered taxpayers need to

-

- Ensure an electronic generation of invoices

-

- Select the right e-invoicing solution. This may have features of operating on-premises, in the cloud or in hybrid mode,

-

- Ensure that the e-invoices are stored electronically

The e invoice KSA should have the ability to generate QR codes based on the ZATCA’s specifications. The QR code ensures that consumers can scan the relevant invoice data using their smartphones. The QR code can be incorporated for B2B bills according to the issuer; however, for B2C simplified bills, it is mandatory. The mandatory fields for VAT that must be incorporated during the first phase include the VAT number of the buyer and the issuance date of the invoice.

The accounting software that your business utilises should fulfil security requirements like preventing uncontrolled access by users, intercepting data manipulation, and making it impossible to alter the counter for the sequence of transactions.

>>>The above Sample ZATCA Tax invoice which is generated through PosBytz <<<

Phase 2 (Integration)

During this phase, the e invoicing in Saudi Arabia of your choice must be integrated with ZATCA’s new central platform for e-invoicing. The taxpayer will be informed 6 months in advance regarding this implementation.

The invoices should be issued in one of the two formats –

-

- The Saudi Arabian XML invoice is constructed on UBL 2.1 syntax and the bill definition of EN16931. This should be narrowed by Saudi Arabian guidelines.

- All e invoicing Saudi Arabia requirement data validations to generate error-free invoices.

- Generates UUID, invoice hash, invoice counter value, QR code & convert invoice into specified XML format as per e invoicing in Saudi Arabia phase 2 requirement.

- Generate XML invoice & receive certified XML back from ZATCA.

- Adding phase 2 QR code & certified XML into an existing invoice to generate final PDF A/3 invoice.

- Automatically emails the final PDF A/3 invoice to your customer.

- ZATCA e Invoicing data archival for up to six years on cloud servers as per ZATCA compliance requirements.

The e invoice KSA must also have strict tamper prevention measures, such as a digitized signature and a hash value as a universally unique identifier(UUID).

Since all the invoices must pass through the ZATCA’s e-invoicing platform, it requires API integration to connect the e-invoicing solution to the central platform.

Why is the KSA government undergoing the transformation to e invoicing Saudi Arabia?

There are two main reasons why e invoicing in Saudi Arabia is being implemented.

The first includes an increase in productivity and transactions. Businesses will notice that they will have quicker and seamless payments and incur lesser costs. The government also has greater visibility on the condition of the market. This means there will be unbiased competition and helps strengthen consumers’ protection in the market.

The second refers to the aspect of security e invoice KSA provides. E-invoices help the government view the movement of goods and services in real-time and prevent black market trade. There will also be an increase in tax compliance, and better decisions can be made thanks to the availability of data the software providers like Posbytz permit.

What to do next?

-

- Impacted businesses need to assess how the new e invoicing Saudi Arabia regulations would affect them.

-

- They need to understand which process systems such as billing, POS, ERP and procurement are affected and whether they have the capabilities for e invoice KSA..

-

- Check which billing system providers can help them immediately configure without delay to the current e-invoicing demands.

-

- Whether the billing solution provider can issue the invoices in Arabic or not.

-

- Look into how the e invoicing Saudi Arabia provider can integrate and comply with ZATCA requirements.

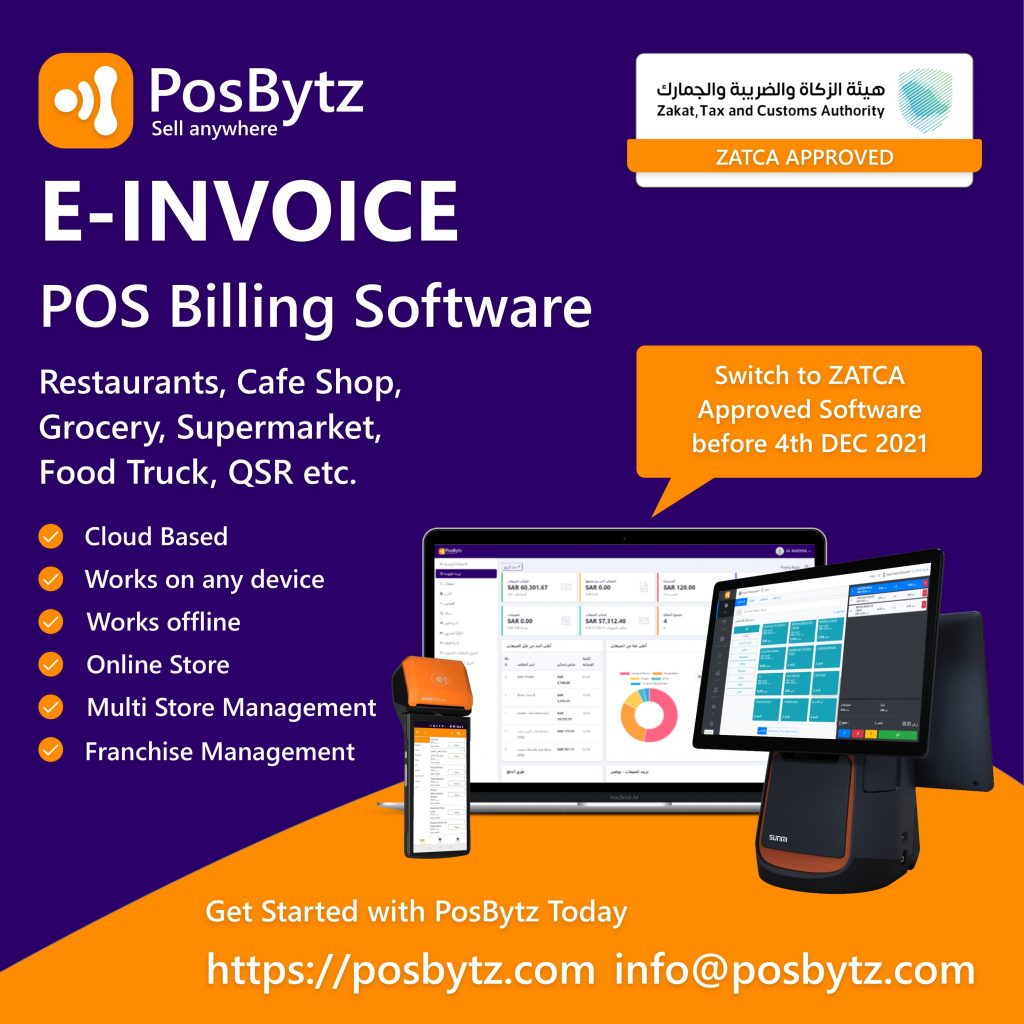

How can Posbytz help?

Posbytz helps you seamlessly manage all your incoming and outgoing invoices and also helps you meet the current technical specifications for e invoicing in Saudi Arabia for POS.

The main benefit Posbytz provides is the ability to keep track of your invoices and generate powerful insights. The added advantage of having ZATCA approved e invoice KSA makes your business operations simpler. PosBytz also offers a free e invoicing Saudi Arabia software to start for evaluation.

PosBytz offers E-invoicing software’s for below businesses in KSA.

– e invoicing Saudi Arabia software for Restaurants

– e invoicing in Saudi Arabia for Retail Stores

– e invoicing Saudi Arabia Trading business

– ZATCA Approved e-invoicing software for Grocery stores

–ZATCA Approved e-invoicing software for Meat stores

– e invoicing Saudi Arabia for Boutique stores

– e invoicing in Saudi Arabia for Cafe shops

– ZATCA Approved e invoice KSA for Food Trucks

ZATCA Approved e-invoicing in Saudi Arabia for Cloud kitchen software

Related Resources

Recent Posts

- “A Complete Guide to Enhancing Retail Operations with Retail Accounting Software”

- Best Accounting Software for Restaurants: A Comparison study

- Simplifying Restaurant Bookkeeping: How to Choose the Right Software for Your Business

- Restaurant Technology Trends 2024: Revolutionizing the Industry

- Optimizing Restaurant Operations with Restaurant ERP Software: A Complete Guide

PosBytz is your comprehensive platform to manage everything you need to sell and grow your business.

PosBytz is a product of Bytize, Inc.